The Frost Fraud: How a $140 Million Scam Betrayed the MAGA Base

Consumer Diligence Special Report, Part 1

Faith Betrayed

They said they were building opportunity rooted in faith. They called it First Liberty, a name that evoked both patriotism and trust. For hundreds of Christian conservatives across Georgia and beyond, that was enough. Retirees wrote checks. Churches pooled money. Small business owners invested savings they could not afford to lose.

What they got back was not growth, it was betrayal. By July 2025, federal regulators accused Brant Frost IV of running First Liberty Building and Loan as a $140 million Ponzi scheme (SEC Complaint). Court filings describe investors who were told their money would fund safe, values driven loans, then learned it was allegedly diverted into personal luxuries and political clout.

“They did not just steal money,” one longtime GOP activist in Coweta County said. “They stole trust from people who thought they were family.”

This was not a random crime. It was a con inside the conservative movement itself, cloaked in religion, patriotism, and party loyalty, and it left as many as 500 families asking how they could be fooled by their own (AJC, Aug 25, 2025).

At a glance

- Alleged amount, about $140 million raised from investors (SEC Litigation Release).

- Investor count, about 300, with state officials saying the number could reach 500 (AJC).

- Emergency actions, asset freeze and a receiver appointed by a federal judge (SEC Press Release).

- Where to verify, the receiver’s public docket and notices are posted at Stretto (case site).

Why it matters

- The alleged scheme targeted communities of trust, churches and GOP networks, which increases the damage and the urgency to self police.

- The fallout includes political donations and media appearances that demand disclosure and accountability.

Key Players

Edwin Brant Frost IV — Founder of First Liberty Building and Loan. Named by the SEC as the central figure in the alleged $140 million Ponzi scheme. Longtime GOP donor with connections across Georgia and neighboring states.

Katie Frost — Daughter of Brant IV. Formerly listed as “Director of Community Impact” at Club for Growth, where she oversaw large philanthropic and political donations. Recently appeared on Newsmax as a GOP strategist, despite her family’s ongoing legal troubles.

Brant Frost V — Son of Brant IV. Resigned as Coweta County GOP chair in the wake of the scandal, but quickly resurfaced in another district-level leadership role, creating rifts inside the Georgia GOP.

S. Gregory Hays — Court appointed receiver tasked with tracing funds, seizing assets, and attempting recovery for investors (Stretto case site).

Judge Timothy Batten Sr. — Federal judge who approved the SEC’s emergency order freezing assets and appointing a receiver.

Investors — Roughly 300–500 individuals, including retirees, church groups, and small business owners. Most were drawn from conservative and faith based networks.

Section 1: The Fraud in Black and White

Edwin Brant Frost IV, founder of First Liberty Building and Loan, was accused by the SEC of orchestrating the scheme (SEC Press Release). His daughter, Katie Frost, and son, Brant Frost V, remain active in Georgia Republican circles.

The operation pulled in about $140 million, and worked like a Ponzi scheme where new investors paid earlier ones instead of funding real loans (SEC Litigation Release). By the time it unraveled in July 2025, regulators cited about 300 investors, and state officials later said the count could reach 500 (AJC, Aug 25, 2025).

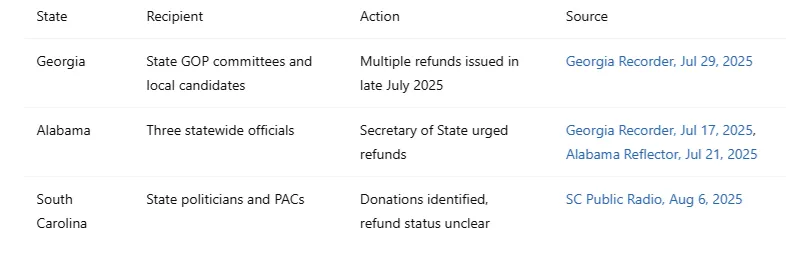

Though based in Georgia, the Frost network reached into Alabama and South Carolina, with donations and ties across state lines (Georgia Recorder, Jul 17, 2025, SC Public Radio, Aug 6, 2025).

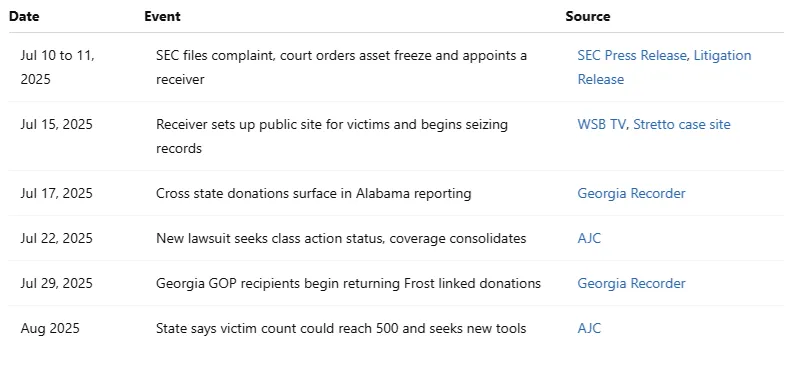

Key dates

- Investors were told their money would fund short term, secured loans. The SEC says investor funds were instead moved to pay earlier investors, which created the appearance of real returns (SEC Complaint).

- The receiver says records were disorganized, which complicates tracing funds and clawbacks (FOX5 Atlanta).

Where to verify

- Complaint PDF, SEC Complaint

- Case summary, SEC Litigation Release

- Press summary, SEC Press Release

- Receiver docket and notices, Stretto case site

What we still do not know

- Any documented, operational role for Katie Frost inside First Liberty beyond public political activity.

- A complete, public list of political beneficiaries and refund outcomes across states.

- Final recovery rates for investors and the full flow of funds once the receiver files comprehensive tracing reports.

Section 2: Betrayal of the Flock

For many of the victims, this was not only a financial hit. They invested because the Frost family presented First Liberty as a values driven enterprise rooted in Christian faith and patriotism. Retirees, churches, and small business owners put in their savings believing they were supporting a cause that shared their convictions (AJC, Aug 25, 2025).

Victim profile

- Faith oriented conservatives in Georgia and neighboring states.

- Retirees and small business owners with limited ability to absorb large losses.

- Church groups that pooled funds with the expectation of safe, secured returns.

How the pitch worked

- Personal networks, church and GOP clubs, and local reputation created social proof.

- Branding as “First Liberty” reinforced trust in both faith and patriot themes.

- Investors were told their money would fund secure loans. The complaint says it did not (SEC Complaint).

What victims can do now

- Register with the receiver and monitor notices at the Stretto page (case site).

- Review the Georgia Secretary of State guidance on contributions and related issues (GA SOS release).

- Keep independent records of deposits and communications to support claims.

Court documents and media reports describe money spent on personal luxuries and political donations while investors were left in the dark (SEC Complaint, FOX5 Atlanta). The disconnect between the Frost family’s public image and the alleged private actions is what makes the scandal sting even more.

“They did not just steal savings,” one activist told Consumer Diligence. “They stole faith from the people who trusted them most.”

Section 3: The Swamp in Miniature

The Frost saga is not confined to investor losses. It is also a story about how political money buys influence and corrodes trust.

Political donations and refunds

Georgia GOP turmoil

In Georgia, the fallout has split the GOP. Brant Frost V resigned as Coweta County GOP chair amid the scandal, only to re-emerge almost immediately in another district-level role, deepening party divisions (Newnan Times-Herald, Aug 2025; The Citizen, Sep 2025).

This is the swamp in miniature: not Washington, but Georgia. A family accused of fleecing hundreds still maneuvering for political standing, and party leaders more concerned with saving face than holding their own accountable.

It mirrors the same patterns that define the larger swamp in D.C.: money laundering into politics, insiders recycling themselves into new titles despite scandal, and institutions that fail to protect the public.

The Frost case shows how the swamp operates at every level, from county GOP clubs to national committees, and why cleaning it up requires more than rhetoric — it requires real accountability.

Summary and Next Steps

The Frost case reveals more than a single fraud. It shows how money, politics, and faith networks can be exploited in ways that damage both people and movements. Part 1 has laid out the foundation: who is involved, how the alleged scheme operated, the betrayal felt by victims, and the political reverberations already underway.

In upcoming installments, Consumer Diligence will dig deeper into:

- Media accountability — how outlets like Newsmax and others platformed Katie Frost while federal litigation was active.

- Network mapping — tracing the Frost family’s donations, allies, and influence across state lines.

- Victim impact — stories from retirees, small business owners, and church groups who were left reeling.

- Systemic gaps — why regulators and party officials failed to catch warning signs sooner, and what reforms could prevent the next Ponzi pitched to conservatives.

This series will continue until every angle is documented and every unanswered question is pursued. The Frost fraud is not just about one family. It is a warning sign of how easily grifters can infiltrate trusted spaces — and why diligence is more necessary than ever.

Have information, documents, or tips? Email us at leads@consumerdiligence.org