(Opinion) The Mirage of Influence: What Brian Allen Reveals About the Digital Grift

From dead websites to unverified claims, Allen’s story shows how digital authority can be manufactured out of nothing.

They slither out of the digital shadows, these so-called influencers, draped in the garb of thought leaders, wielding massive followings like a cudgel to dominate political discourse.

They pontificate on X with viral clips, snappy hot takes, and carefully curated selfies, their posts retweeted into oblivion by ideologues with agendas as murky as a swamp at midnight.

But who are they, really?

What grants them the authority to shape your views?

Too often, they’re astroturf frauds — polished fronts for schemes that thrive on your trust and vanish when the spotlight burns too bright.

Enter Brian Allen, self-styled financial bigshot and political “sledgehammer.”

His name’s buzzing, his X account’s ballooning, but peel back the veneer, and you’ll find a house of cards built on a dead website and unverified credentials.

So, who the heck is Brian Allen, and what’s the deal with his shadowy Lime Funding outfit?

Consumer Diligence dug deep, and the dirt we found should make you think twice before buying into his hype.

The Illusion of Brian Allen

Brian Allen burst onto the scene in 2025, his X handle @Allen_Analysis racking up more than 200,000 followers with a bio that screams self-aggrandizement: “Founder & Editor-in-Chief @ allenanalysis.com 2B+ views/year | Political sledgehammer.”

He brands himself as a high-roller in real estate and finance, founder of Lime Funding and Business Services, LLC, promising “tailored mortgage and lending solutions” and boasting a “wealth of experience” at Fortune 100 mortgage firms.

His allenanalysis.com site doubles as a political soapbox, with fiery anti-Trump posts on Epstein disclosures and “#NoKingsDay” protests, aligning with the Lincoln Project’s anti-MAGA crusade.

But the cracks in Allen’s facade are glaring.

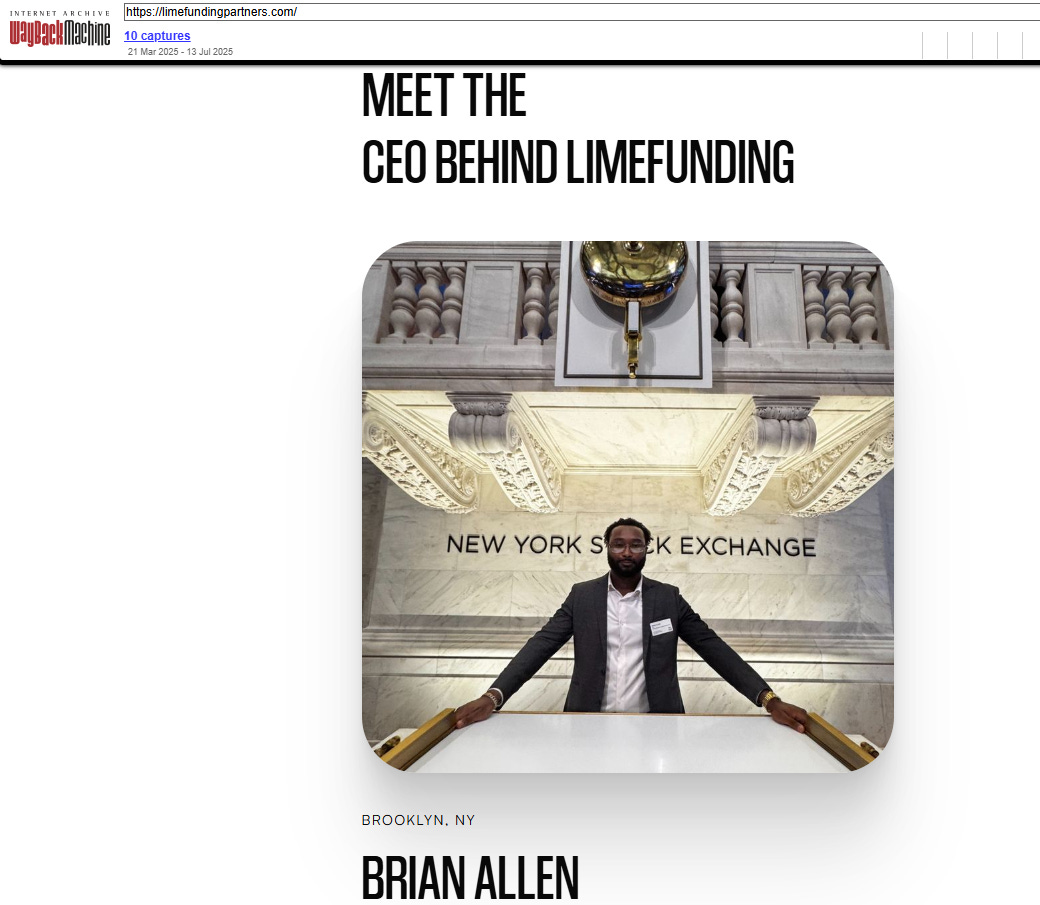

His primary website, limefunding.org, is a digital ghost town — unreachable, returning no content. Wayback Machine archives show limited activity, with snapshots from October 2024 and January 2025 capturing a blog and homepage, but no operational details, client testimonials, or product specifics.

The secondary site, limefundingpartners.com, previously active and touting Allen’s social media clout, is also now defunct, with a March 2025 Wayback snapshot revealing promotional content but no evidence of active operations.

The collapse of both websites raises stark questions: How does a purportedly booming business, lauded for its innovative lending and massive online reach, simply abandon its digital presence?

No LinkedIn company page for Lime Funding exists, and searches for employees yield only Allen’s sparse personal profile, lacking endorsements or detailed history

Searches for Lime Funding’s LLC filings in New York, Florida, Delaware, and Nevada, states which represent both the operational epicenter and common incorporation havens for U.S. businesses, turn up empty — no registration, no EIN, no mortgage banking licenses.

For a company founded in 2020, per Inc.com, this absence of a paper trail screams shell operation.

The absence of filings, including Employer Identification Numbers and mortgage banking licenses, underscores broader concerns about the entity's legitimacy, especially given Allen's claims of operating a thriving mortgage and lending firm from New York.

Red Flags Piling Up

Allen’s credentials raise even more alarms.

He claims a “proven track record” in high-stakes finance, yet reports suggest he holds only an associate degree — hardly the resume of a visionary financier.

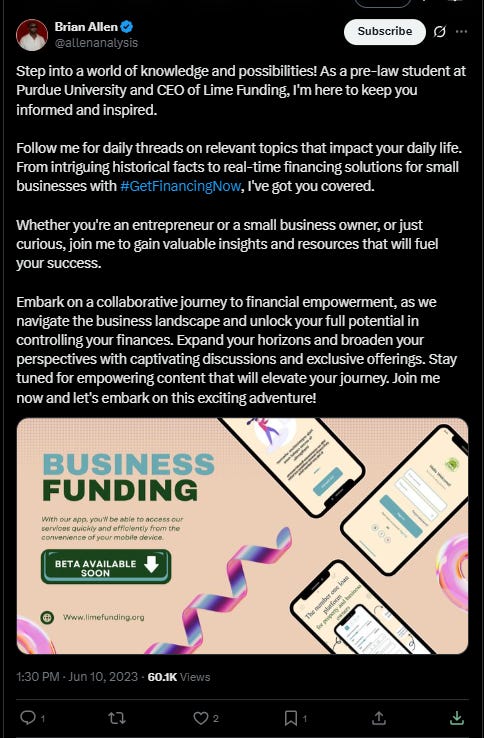

Meanwhile, Allen has claimed on X to be a “pre-law student at Purdue University” while also serving as CEO of his financial firm, a statement that has sparks scrutiny the typical requirements for pre-law status.

In a June 2023 post, Allen boasted, “Step into a world of knowledge and possibilities! As a pre-law student at Purdue University and CEO of Lime Funding, I’m here to keep you informed and inspired,” promoting daily threads on topics from historical facts to small business financing under the hashtag #GetFinancingNow.

With only an associate degree, a two-year credential, he falls short of the bachelor’s degree required for pre-law status or law school eligibility, casting doubt on his claim.

The discrepancy is significant, as an associate degree alone does not qualify an individual for pre-law status under standard academic definitions or law school admission criteria.

Without evidence of a bachelor’s degree or enrollment in a four-year program at Purdue, Allen’s assertion appears inconsistent with his educational background and the university’s pre-law requirements.

Searches for real estate deals, SEC filings, or property records tied to Allen or Lime Funding in Staten Island (his claimed base) or elsewhere yield nothing—no transactions, no licenses, no footprint.

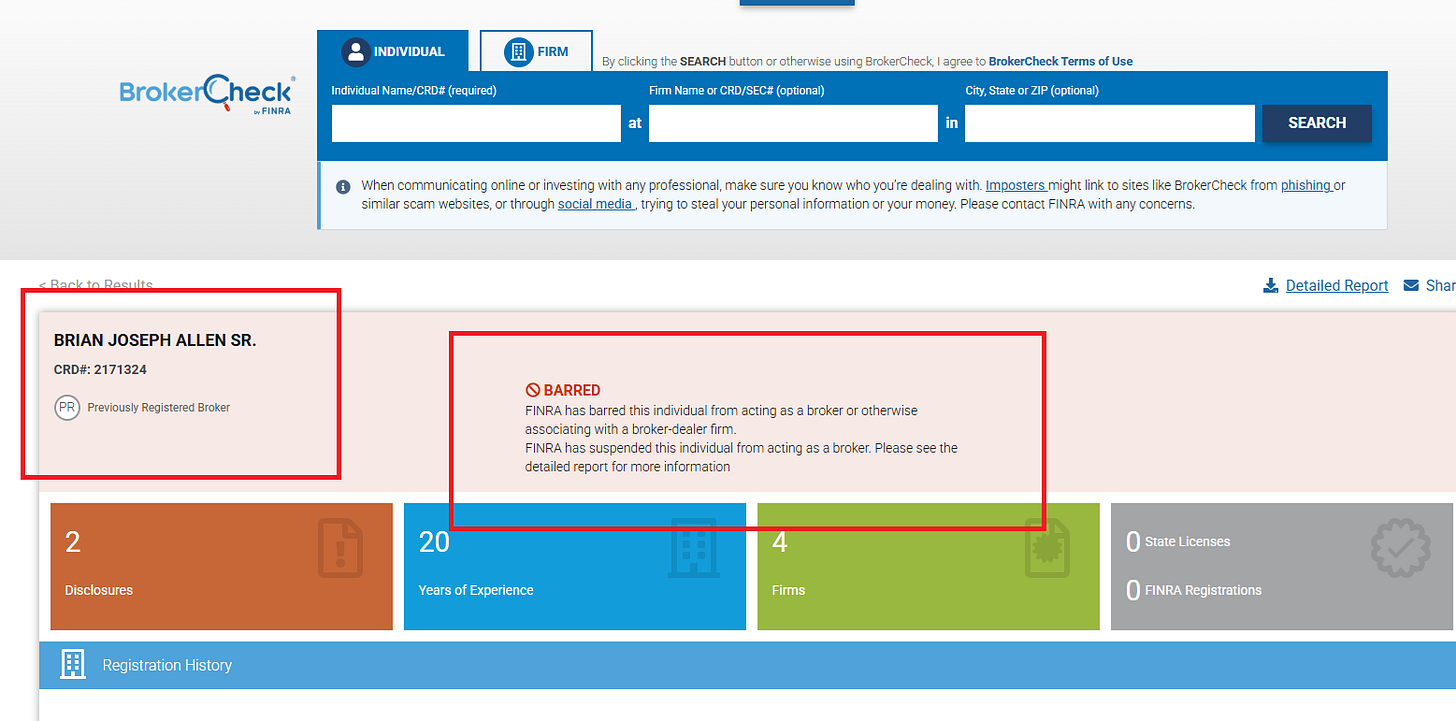

The Financial Industry Regulatory Authority Broker Check database lists a Brian Joseph Allen Sr., CRD# 2171324, as permanently barred from associating with any broker-dealer firm and currently under suspension from acting as a broker, with details available in his full report.

While FINRA records do not explicitly confirm a match to the Brian Allen associated with Lime Funding and the X handle @Allen_Analysis, the alignment is striking: both individuals are tied to the financial services sector, with the barred broker's history involving securities and potentially overlapping mortgage-related activities common in broker-dealer roles.

The Lime Funding Allen claims senior experience at Fortune 100 mortgage companies and operates in New York—a major hub for such firms—mirroring the professional footprint where FINRA bars would apply.

FINRA's bar, a severe sanction typically imposed for violations like fraud, unauthorized trading, or failure to supervise, prohibits the individual from any securities-related work, which could extend to advisory or lending roles if tied to investment products.

Consumer Diligence could not independently verify the connection due to limited biographical details in the summary report, but the shared name, New York nexus, and finance focus warrant deeper investigation by potential clients or regulators.

This finding compounds existing concerns about Lime Funding, whose websites have vanished and whose LLC filings remain absent in key states.

If confirmed, it would represent a major undisclosed risk for consumers engaging with Allen's purported mortgage and lending services.

Consumer Diligence recommends cross-referencing CRD# 2171324 with Allen's full background before any financial dealings.

His LinkedIn profile, listing him as “Senior Mortgage Banker” at Lime Funding, is a barren wasteland — no endorsements, no connections, and no company page to back it up .

A May 2024 Yahoo Finance press release reads like paid fluff, touting Lime Funding’s “technology-driven” lending but citing no verifiable deals or clients.

Where are the employees? The offices? The proof?

It’s all smoke and mirrors.

Then there’s the political angle. Allen’s X posts, dripping with anti-Trump venom, dovetail neatly with the Lincoln Project’s “Never Trump” playbook.

His rants on Epstein and protests in cities like NYC and Lincoln, Nebraska, echo the group’s #NoKingsDay campaigns

While direct retweets from @ProjectLincolnare absent, Allen’s content swims in the same anti-MAGA ecosystem, boosted by influencers like @newrepublic and threads hinting at Lincoln Project proximity.

This isn’t coincidence — it’s a calculated play to capture trust in a polarized “parallel economy,” funneling followers toward an unverified finance hustle.

The Lincoln Project is no stranger to scandal itself.

The prominent anti-Trump super PAC has faced multiple controversies that heighten scrutiny of its apparent amplification of Allen. The group’s scandals include co-founder John Weaver’s 2021 sexual harassment allegations involving 21 young men, prompting resignations and donor backlash; accusations of funneling over $100 million to founders’ firms with only a third spent on ads; and a 2021 Virginia tiki torch hoax staging fake white supremacists to smear a Republican candidate.

While no direct Lincoln Project retweets of Allen’s @Allen_Analysis account were found, his anti-Trump posts align with their campaigns, suggesting informal boosting within their ecosystem.

These controversies raise questions about the credibility of figures like Allen promoted within the Lincoln Project’s orbit.

The Bigger Picture

Allen’s rise fits a disturbing pattern: self-anointed “influencers” leveraging political outrage to peddle dubious ventures.

Lime Funding’s lack of transparency mirrors the Lincoln Project’s own financial opacity $100 million raised, with millions funneled to founders’ firms and only a fraction spent on ads.

Both exploit trust, blending ideology with opportunism.

No FEC filings, board memberships, or direct payments link Allen to the Lincoln Project, but their shared ecosystem raises red flags about coordinated amplification (https://www.fec.gov/data/committee/C00725820/).

If Allen’s a financial guru, where’s the evidence?

If Lime Funding’s legit, where’s the infrastructure?

The silence is deafening.

Don’t Get Suckered

The digital age breeds these chameleons — smooth-talking “experts” who materialize with big followings and bigger promises, only to crumble under scrutiny.

Brian Allen’s Lime Funding is a textbook case: a slick front with no substance, riding the coattails of political tribalism to cash in on your trust.

He’s not alone; the Lincoln Project’s scandals prove the game’s rigged for grifters.

Don’t fall for the hype.

Check who you’re trusting before you buy in.

The truth doesn’t hide forever, and neither should you.

Become a Founder at Consumer Diligence for exclusive access to all full reports, like this one. Support our mission today!

Got tips on someone like Allen or Lime Funding? Drop it at leads@consumerdiligence.org.

SOURCES:

https://www.inc.com/profile/lime-funding

https://finance.yahoo.com/news/lime-funding-transforming-financial-services-171500746.html

https://web.archive.org/web/20241010033428/https://www.limefunding.org/blog

https://web.archive.org/web/20250118082425/http://limefunding.org/

https://web.archive.org/web/20250000000000*/http://limefunding.org/

https://www.nytimes.com/2021/01/31/us/politics/john-weaver-lincoln-project-harassment.html

https://mashable.com/article/lincoln-project-scandal

(https://www.nytimes.com/2021/01/31/us/politics/john-weaver-lincoln-project-harassment.html) (https://mashable.com/article/lincoln-project-scandal) (https://capitalresearch.org/article/the-lincoln-project-sells-revenge-rather-than-results-unforced-errors/

https://www.opensecrets.org/political-action-committees-pacs/lincoln-project/C00725820/2024