DOLLAR GENERAL EXPOSED: Overcharging the Poor, One Penny at a Time

Dollar General has one price on the shelves but charge much more at checkout.

Under the harsh hum of a Dollar General parking lot light, a shopper studies her receipt — and realizes she’s been robbed in plain sight.

The prices don’t match. A $1.99 can of soup rings up at $3.49. A $2.50 box of diapers scans for $4.35.

It feels like a mistake. It isn’t.

What looks like pennies lost at the register adds up to millions siphoned from the pockets of working Americans. Behind the yellow signs and “low-price” promise lies one of the biggest, longest-running retail deceptions in the country! A corporate scheme so ordinary it hides in plain sight.

This is the real cost of Dollar General.

Scott Olson / Getty Images

ANALYSIS NOTE

This is not misfortune. This is method. And it touches every American, whether they ever set foot in a Dollar General or not.

Dollar General Corporation, the $41.7 billion retail behemoth, with over 20,600 stores across 48 states and Mexico and roughly 194,200 employees as of February 28, 2025, has built an empire on the promise of affordability for America’s working poor.

Yet a Consumer Diligence investigation reveals a decades-long pattern of deception, safety failures, and regulatory evasion that exploits the vulnerable while undermining trust in American commerce.

The scandals unfold in relentless succession, each chapter darker than the last, and each one paid for by consumers nationwide.

A Dollar General store opened in Manson in 2017, offering food and household items to local residents. (Photo by Linh Ta/Iowa Capital Dispatch)

The deception began in corporate boardrooms long before it reached the checkout lane.

Between 1998 and 2001, Dollar General executives engaged in systematic accounting fraud to inflate earnings and secure bonuses.

The Securities and Exchange Commission charged the company with underreporting $10 million in freight costs, orchestrating an $11 million sham sale of obsolete cash registers, and manipulating “rainy day” reserves to mislead investors.

The scheme forced a $143 million restatement of earnings, the largest in the company’s history.

In 2005, Dollar General settled with the SEC for $10 million without admitting wrongdoing, while executives paid $400,000 in disgorgement and faced lifetime bans from public company roles.

Credit: Richard Drew/AP Photo

Safety failures followed.

Since 2010, the Occupational Safety and Health Administration has cited Dollar General in over 243 inspections, issuing more than $15 million in penalties for blocked emergency exits, unstable merchandise stacks, and electrical hazards.

In 2017 alone, OSHA fined the chain $2.2 million across multiple states for repeat violations.

By 2022, Dollar General became the first retailer designated a “severe violator” under OSHA’s expanded enforcement program, with $15.5 million in proposed penalties for 111 willful and repeat citations.

The pricing scandal erupted publicly in 2019.

“Dollar General’s growing record of disregard for safety measures makes it abundantly clear that the company puts profit before people,” said OSHA Regional Administrator Kurt Petermeyer in Atlanta. “These violations are preventable, and failing to prevent them shows a blatant disregard for the workers on whom they depend to keep their stores operating. OSHA continues to make every effort to hold Dollar General accountable for its failures.”

Vermont regulators fined Dollar General $1.75 million after inspectors issued 50 prior warnings for deceptive advertising and overcharges that went unaddressed.

“Deceptive advertising will not be tolerated,” Attorney General Donovan said. “Knowing that Dollar General caters to low-income Vermonters makes their repeatedly misrepresenting prices particularly egregious. I’m pleased that part of this settlement will directly benefit those Vermonters who struggle with food insecurity.”

Auditors found consistent discrepancies between shelf tags and register scans on essentials like milk, bread, and cleaning supplies.

The settlement included $100,000 to the Vermont Foodbank, acknowledging the harm to low-income shoppers.

The crisis escalated in 2022.

Ohio Attorney General Dave Yost sued after 12 consumer complaints triggered audits of 20 Butler County stores.

Inspectors documented error rates as high as 88.2 percent — 44 times the legal limit of 2 percent.

Specific overcharges included Coffee-Mate creamer ($2 shelf vs. $4.35 scan), frozen chicken strips ($7.95 vs. $10.75), and soda multi-buy deals that never applied.

In October 2023, Dollar General settled for $1 million, with $750,000 directed to food banks.

Missouri struck next.

In September 2023, Attorney General Andrew Bailey filed suit after audits of 147 stores revealed violations in 92 locations.

Over 5,000 items were tested; average overcharges hit $2.71, with peaks at $6.50 on candles, toilet paper, and lemonade.

The case, pending in St. Louis County, seeks full restitution and civil penalties up to $40,000 per violation.

New Jersey followed in November 2023.

Inspections of 58 stores uncovered over 2,000 overcharges, some exceeding $5.95. The state secured a $1.18 million settlement in December 2024, mandating annual audits and employee training.

Wisconsin settled in November 2023 for $850,000 after finding 662 overcharges across 200 stores.

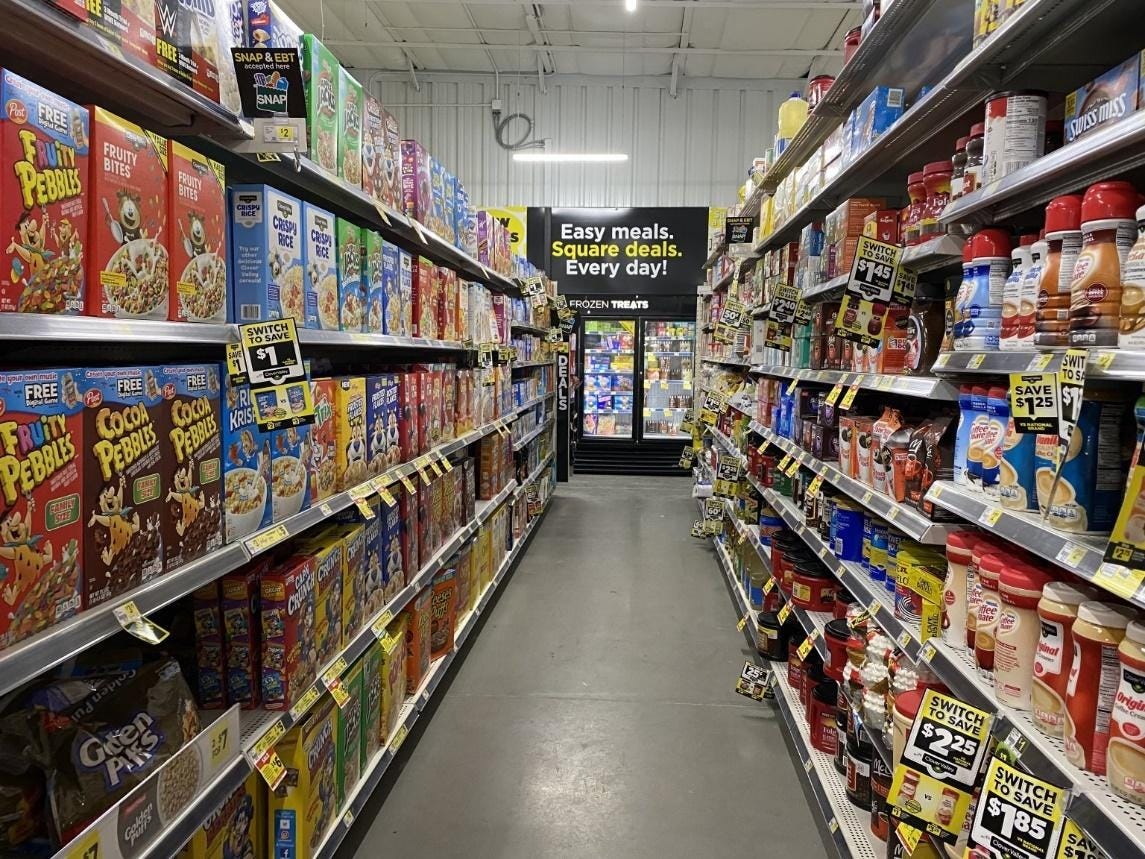

Prices on Dollar General shelves don’t match what’s charged at checkout

The labor reckoning came in 2024.

In July, the U.S. Department of Labor announced a landmark $12 million settlement with Dollar General to resolve nationwide safety violations.

The agreement required regional safety managers, employee safety committees, reduced inventory heights, and third-party audits.

Noncompliance triggers $100,000 daily fines, up to $500,000 per violation.

Class-action lawsuits surged in 2024 and 2025.

An Ohio federal suit alleges overcharges at 943 stores, citing milk ($4.15 vs. $4.25) and water ($0.85 vs. $0.95).

A Florida case filed in August 2025 claims nationwide bait-and-switch tactics, referencing prior state actions.

Plaintiffs estimate millions in aggregate harm.

Colorado fined the chain $400,000 in October 2025 for persistent overcharges on essentials.

North Carolina collected $71,000 in fines from 2022 to 2023.

Dollar General’s cumulative penalties exceed $90.8 million across 292 records since 2000, per Violation Tracker.

The company reported $41.7 billion in trailing 12-month revenue as of October 2025.

This matters to every American.

Dollar General’s footprint is vast: the company itself and researchers note that about 75 percent of Americans live within five miles of a Dollar General store, and many locations serve small towns and rural communities.

Low-income households spend a far larger share of their budgets on food than wealthier households; in 2023, households in the lowest income quintile spent roughly 32–33 percent of after-tax income on food, according to USDA data.

Overcharges extract wealth from the poorest households — those spending nearly 40 percent of income on food and essentials — exacerbating inequality.

Analyst Note

When trust erodes in basic commerce, all consumers pay: higher vigilance, lost time, and a culture of suspicion that inflates prices across retail.

The company’s labor violations endanger 185,800 workers and contribute to high turnover, driving up training costs passed to consumers.

Its dominance in rural markets stifles competition, limiting options for all shoppers. And when a $24.3 billion public company normalizes fraud, it sets a precedent that weakens regulatory enforcement nationwide.

A company spokesperson said in early 2023 that Dollar General Corporation is “committed to providing customers with accurate prices on items purchased in our stores, and we are disappointed any time we fail to deliver on this commitment. When a pricing discrepancy is identified, our store teams are empowered to correct the matter on the spot for our customers.”

However, the company’s settlements consistently include no admission of wrongdoing. For example, in Wisconsin’s $850,006 settlement, the company “does not admit to any violation” under the agreement).

And despite required follow-up plans in states including Ohio, Missouri and Wisconsin, regulators and consumer complaints indicate that mandated reforms — like systematic shelf-tag audits or full price-accuracy compliance checks — remain largely unenforced or under-monitored across multiple states.

Violence compounds the risk.

Active police scene at the Dollar General on Norwich Street, Connecticut on October 28, 2025.

Dollar General stores have recorded 49 gun-related deaths and 172 injuries between 2014 to 2023, according to a 2023 analysis by the Gun Violence Archive.

Former employees report minimal security — often a single camera and no overnight guard — despite high cash volumes.

Corporate fraud taints the ledger.

Cashiers and shoppers across the country speak for millions.

Many hourly workers at Dollar General Corporation report earning around $12 an hour, according to publicly-reported wage data. Meanwhile, consumer-protection investigations and review-site complaints document numerous instances of price-tag vs. register scanning mismatches — the kind of overcharges that critics say place extra burdens on low-income families.

Dollar General workers and community supporters protest in front of their store in Marion, NC on May 2, 2022.

Every overcharge means a meal skipped for their children, according to widespread consumer complaints filed with state attorneys general and posted on review sites.

The receipt flutters to the asphalt, another silent casualty. Behind it stands a corporation that profits from precision in deception, while America foots the bill in trust, safety, and dignity.

The bargain looks cheap. The true cost runs deep.

Can You Help Us?

Have a tip? Send leads to leads@consumerdiligence.org